In 2015, it may not be easy for pharmaceutical distributors. The non-base medicines in various regions will be tossed by turtle speeds. Medication drug bidding will stagnate, the distribution rate will not meet the standard blacklist system, and online sales of prescription drugs will be lifted... More tragic. Yes, the overall sales growth of the industry has hidden water, and the growth rate of the industry has declined year by year. These factors forced the industry to accelerate the reshuffle: In the hospital terminal area, those small and scattered distribution companies, in the future want to grab food from the Big Mac Bowl is not an easy task; in the retail terminal, prescription drug network sales The lifting of the ban may smash the retailer’s rice bowl.

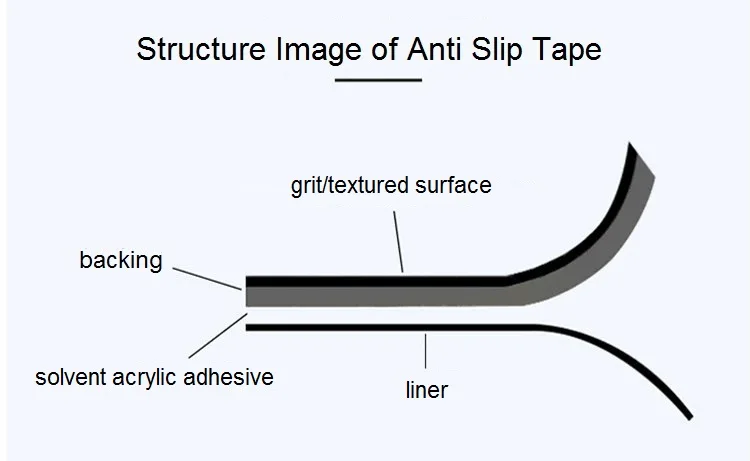

Anti slip tape

Jerry tape is specialized in anti slip tape for 10 years. Our anti slip tape is designed with a highly durable weatherproof triple layer adhesive which is imported from Japan to make sure your tape does not peel off easily. It offers extra traction,help reduce the risk of slipping and falling when you go up and down the stair,Great for the family with kids pets and elders,Durable waterproof anti skid tape for steps is perfect for outdoor and indoor use.

1. Material of Jerry tape anti slip tape

2. Features of Jerry tape anti slip tape

1).Grit sandpaper surface with adhesive back.

3. Applications of jerry tape anti slip tape

1).Floor,stair,slope Anti Slip Tape,Anti Skid Tape,Non Slip Tape,Non Skid Tape Kunshan Jieyudeng Intelligent Technology Co., Ltd. , https://www.yuhuanptapes.com

Decline in growth rate forced shuffling

The "Blue Book of Pharmaceutical Distribution Industry" released by the Ministry of Commerce has shuddered the circulation of medicine. In 2013, the total sales volume of the pharmaceutical distribution industry was 130.3 billion yuan, a year-on-year increase of 16.7%, and the growth rate was down 1.8 percentage points from the same period of last year. The growth of the pharmaceutical terminal market is the main driving force for the growth of the circulation industry. Although the total sales volume of the pharmaceutical circulation industry has increased, the growth rate has declined, making the competition among the 16,000 circulation companies in the industry more intense.

According to Xie Xiaobo, marketing director of Sichuan Kelun Xinguang Pharmaceutical Co., Ltd., the decline in the growth rate of the industry can best reflect the current status of the industry. The first wavelet explained that the deceleration of growth rate year by year shows that the circulation industry is gradually reshuffled, and the industry has begun to develop into a group, refined, and specialized industry. “In the process of reshuffling, circulation enterprises that do not have their own characteristics and profits derived only from excessive fees will gradually be eliminated. In other words, the development of the circulation industry will be in line with the commercial "28 law", that is, 20% of large circulation enterprises. It will control 80% of the market's sales share, and the circulation industry will be gradually improved.â€

The data of the Ministry of Commerce confirms the view of the first wavelet, and the "two-eight law" of the circulation industry is gaining momentum. The survey results of the Ministry of Commerce show that pharmaceutical distribution has become the fastest growing sub-sector in the pharmaceutical industry. In 2013, there were 12 pharmaceutical wholesale enterprises with main business revenues above 10 billion yuan, 11 companies with 50-100 billion yuan, and 75 companies with 10-50 billion yuan. Among them, the income of the top 100 wholesale companies accounted for 64.28% of the total market size in the same period.

Industry sources also revealed that the scale of sales in the industry, which looks like a rising trend, actually has hidden water. "The increase in total sales year after year may be an illusion, for example, the ex-factory price of a certain drug is 5 yuan, and it is sold to 8 yuan by the agent, and then through the hands of two agents, it can be sold for 14 yuan. If a drug passes 5 Even more home circulation companies, sales will increase several times. Therefore, the total industry sales does not represent the substance, on the contrary, sales in these years should decline.

Powerful Hengqiang Market Structure

At present, the competitive landscape of the pharmaceutical distribution industry has basically taken shape. According to the strength of domestic pharmaceutical distributors, the top three companies in the industry should be Sinopharm, Shanghai Pharmaceuticals, and Kyushu, followed by Guangzhou Pharmaceuticals, Beijing Pharmaceuticals, Nanjing Pharmaceuticals. According to industry analysts, the situation of the strong and permanent will lead to an acceleration of the industry's differentiation, and small and scattered circulation traders may not be squatters.

Sinopharm Group is the first pharmaceutical circulation company that has sold hundreds of billions of dollars. As a company under the SASAC, Sinopharm has a good advantage of government resources. It is the chief distributor of most imported drugs in China, and it is mainly positioned as a distributor of high-end drugs, and it is the most profitable cake in the field of pharmaceutical circulation. With the promotion of medical reform policies, since 2009, Sinopharm has relied on good government resources, strong Sinopharm Group and funds raised from listing to continuously accelerate the acquisition of circulation companies in various provinces and stepped up cooperation with major hospitals in “pharmacy trusteeshipâ€. Business, the status of the leading leader in the future is not likely to shake.

Shanghai Pharmaceutical Co., Ltd. is closely following Sinopharm Pharmaceuticals, which has formed a full-industry chain business including R&D, manufacturing and distribution retail. Pharmaceutical distribution is still its most important business, and it is now accelerating the nationwide network layout. According to industry analysts, in terms of government resources, Shanghai Pharmaceuticals is not as good as Sinopharm, and its main market is in the East China region. If you want to go to the country and sit on an equal footing with Sinopharm, it will take some time.

Compared to the above two peers, the advantages of Kyushu Express are being flattened. Its original market positioning and the identity of its private enterprises have caused it to fall into a dilemma. Kyushutong mainly sells low-end and middle-end medicines, and takes primary-level medical institutions and private hospitals. According to Zhong Luling, who is an insider of the industry, Kyushutong can only expand the doors of large hospitals. How to enter the high-end market will become a problem that Kyushu Express urgently needs to solve.

However, the above-mentioned Big Three are basically still in the "big but not strong" stage. The circulation industry originally relied on the mode of selling and selling differentials and rebates. In the context of the new medical reform, it has been unable to establish a foothold, and circulation companies have to explore new profit models. Sinopharm Group, Shanghai Pharmaceuticals, etc. are all trying out third-party logistics, seeking pharmacy trusteeship in hospitals, providing information services for upstream pharmaceutical companies, and carrying out OEM production. In particular, Sinopharm Group is the fastest-growing company.

According to the vision of Sinopharm, its future profit model will mainly consist of two parts: First, provide logistics services for upstream pharmaceutical companies and collect logistics service fees; pharmaceutical companies will no longer need to build their own logistics centers; second, help pharmaceutical companies sell pharmaceutical products. Completely replaces the role of medical representative. According to Sinopharm Holdings, pharmaceutical companies are only responsible for making drugs. Others are handed over to them. According to estimates of relevant parties of Sinopharm, this change will be expected to take 10 to 15 years.

Prescription drug net sale lifts ban impact retail end

According to Liu Xiaoping, an official of the State Food and Drug Administration (CFDA), the “Administrative Measures on the Supervision and Administration of Internet Food and Drugsâ€, which was previously issued for the draft, will be discussed at the recent CFDA director's office. If approved, this approach will be subject to departmental regulations. In the form of release. According to industry sources, the "Measures" will allow some prescription drugs to be sold on the Internet. In the future, the medical e-commerce business will rob rice bowls with real retailers.

The following pairs of data may summarize the current state of the retail market. In 2014, there were more than 460 physical pharmacies in China, but the average daily traffic volume of only one store was only 75 people. The average daily daily traffic was about 30 million. In stark contrast to this, the average daily traffic of 207 online pharmacies 60,000 people, with an average daily flow of 120 to 16 million. In terms of customer unit price, the unit price of offline physical store customers is 60-80 yuan, and the average annual shop sales is 500,000 yuan; while the online pharmacy customer unit price is 150-280 yuan, and the average annual shop sales are about 50 million yuan. In terms of growth rate, sales of offline stores grew by 11% in 2012 and declined to 9.3% in 2013. In the first half of 2014, the growth was only 8%; in stark contrast to the market share of online pharmacies from 2011. The 400 million yuan rose all the way to 4.26 billion in 2013, and is expected to exceed 12 billion in 2014, with an average annual growth of more than 150%.

In terms of sales, the current online pharmacy is the best in the network, with only one month's worth of mobile phone sales exceeding 4 million, and more than 1 million online pharmacies on the mobile phone side. In terms of coverage area, online pharmacies are even under explosives. Although the online pharmacy single shop has a large investment, the coverage area can be extended to many provinces and cities and even to the whole country with the extension of the promotion scope. The physical pharmacy has the most coverage. Not more than 5 kilometers, the actual coverage does not exceed 1.5 kilometers, and some chain pharmacies cover more than 1,000 stores in one province.

In terms of investment income, taking Kang Ai Duo as an example, the company has started funding of 12 million yuan, more than 400 employees, and 5 stores. After three years of rapid growth, the sales volume has already surpassed 100 million in three years, and the sales volume has exceeded 1 billion for five years. The speed is far beyond the traditional store model.

The above data is only a summary of the sales of OTC products. Industry insiders expect that with the lifting of Internet sales of prescription drugs, medical e-commerce will usher in a broader market blue ocean. After the supporting systems such as logistics distribution and practicing physicians are mature, the retail end of the entity may fear the defeat of medical e-commerce.

2).Grease and water resistant.

3).Temperature range -40° to 158°F.

4).Extra-wide rolls up to 3 ft. ideal for ramps and walkways.

5).Heavy Duty - Thicker extra-coarse surface with aggressive adhesive. For muddy, greasy and oily areas.

2).Machines and motor vehicles

3).kitchens and canteens

4).Prevention of slipping accidents

5).Fixes smooth, wet, oily and greasy floors

6).Non-slip demarcation